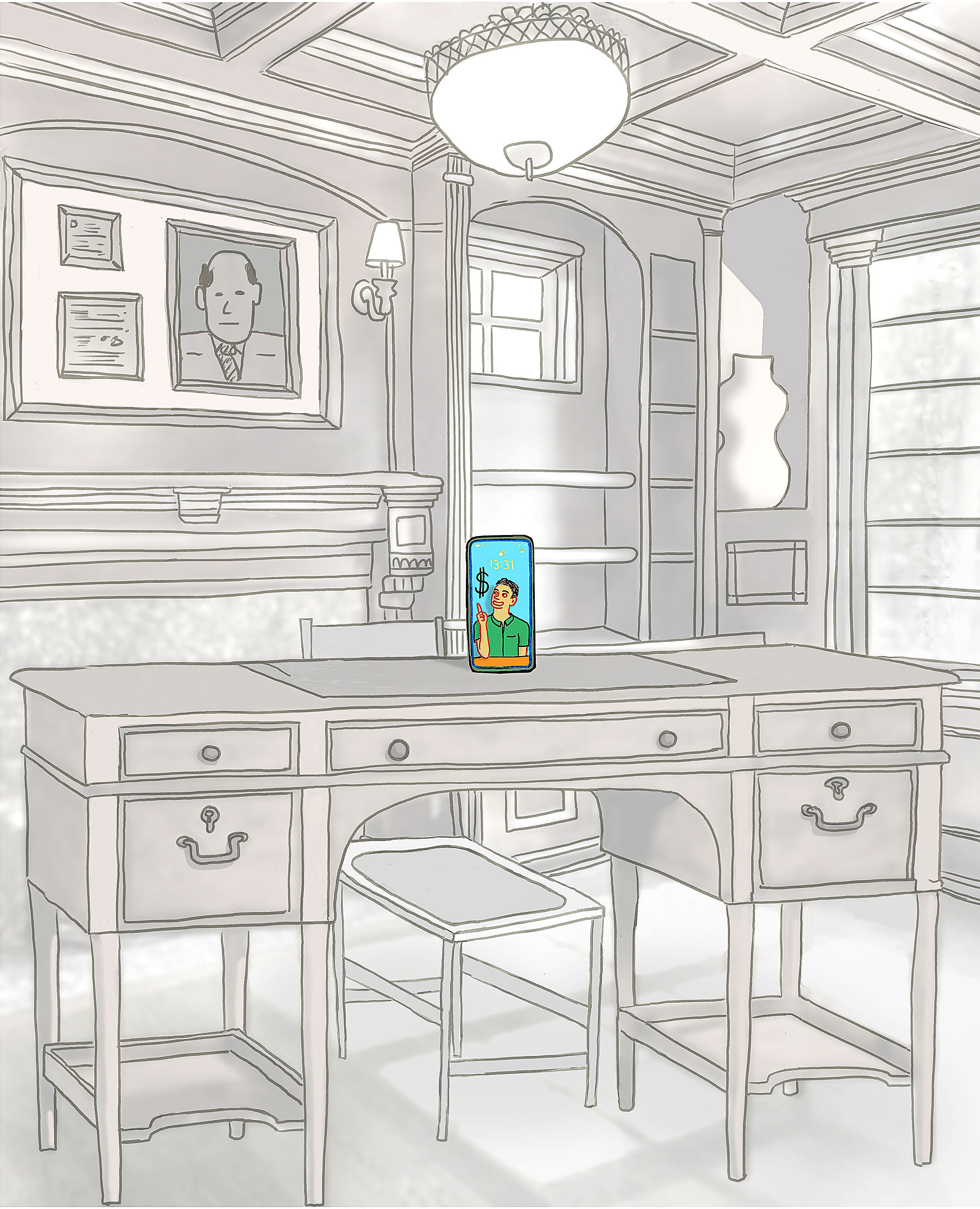

A few decades ago, most financial advice was seen as beyond the ken of mere mortals. You had to go to a specialist—a financial planner or adviser—usually seated behind an imposing desk at your local bank branch. First, they’d tell you what you needed to do from a preset menu of options, kept under lock and key, and then offer you the limited products or services sold exclusively at that bank.

The internet has democratized this process as it has many industries. Investors can now do more research, access competing financial products, and make investment decisions without an intermediary. Often, they use an app on their phone. While the DIY trend was in full swing before COVID, the pandemic has accelerated people’s desire to better understand their finances. And younger generations (especially Gen Z and Gen Y) are increasingly turning to social media stars—dubbed “finfluencers,” or financial influencers—for some of that advice.

TikTok, the viral video-sharing app, has become a popular destination for all sorts of tips and tricks, covering every topic from cooking to relationships to fashion. But money talk in particular has taken off: by early October, videos on TikTok with the hashtag #PersonalFinance had racked up 4.7 billion views, while those tagged #Investing had been viewed more than 3.7 billion times. While some videos are titled “How Taxes Actually Work,” “Payday Routine,” or “Family Budgeting,” much of the advice is on how to turn $5 into $5,000—or buy “four stocks that will make you rich by 2023.”

For those who provide financial advice for a living, the power of social media to spread knowledge is a double-edged sword. While it’s good that younger generations are being introduced to what’s often seen as a dry subject—and from people who don’t have a vested interest in what’s being touted—there’s also a lot of oversimplification of complex personal finance decisions.

“I’ve gone through the TikTok world, and to me it feels like it’s extremely focused on get-rich-quick schemes,” says Max Mitchell, a 39-year-old accredited financial counsellor based in Vancouver. Mitchell has made a name for himself with his own viral videos, which similarly target people in their twenties and thirties but focus more on what he calls “accumulating wealth, and building your financial future and healthy financial habits.” A recent video, “Understanding TFSA Contribution Room,” combines illustrations, meme-worthy photos, and humorous sound effects—along with some pretty solid financial advice.

Mitchell thinks that, in part, the cursory treatment of financial issues on TikTok (where videos are typically under a minute long) is leading to some bad advice—from people who aren’t qualified to give it. “What these finfluencers don’t do, is they don’t show the options. All they say is, ‘Hey, here’s something—put your money into this, and it will work out.’ And that is inherently irresponsible.” Mitchell’s videos (which mostly reside on YouTube) are longer—eight to 14 minutes—and are there to educate and improve financial literacy. They also promote his main practice: delivering virtual financial counselling to students and young professionals.

The irreverent tone of Mitchell’s videos reflects who he is but also the audience he’s speaking to. “If you look at a bank ad or look at the physical environment of a bank, who’s behind the counter? Somebody wearing a tie and collared shirt, or a dress,” he notes. “And the people who are standing across from them are not 20 years old; they are my parents’ age.” But Mitchell’s approach to financial counsel goes beyond just style; he sees his job as breaking down walls for novice investors. He’s particularly critical of the power of traditional financial institutions to steer customers in a self-serving direction.

“You know, there are 88 banks in Canada—and 90 per cent of Canadians bank with five of them,” Mitchell says. “They have an absolute monopoly—not because they offer better service or cheaper prices; it’s just pure legacy.” Young investors still want coaching and empowerment—more than a 30-second TikTok video can offer, he says—but they want to control their own financial destiny, whether through a no-fee online bank, a robo-adviser or other DIY investing tools.

The old-school banks and money managers are paying attention. Shelly Appleton-Benko, a portfolio manager with Vancouver-based investment firm Odlum Brown, wrote a blog post in late August tackling the “finfluencer” trend head on: “While it is encouraging to see this generation gaining an interest in these topics, the finfluencer space is a bit like the Wild West—you may never know the quality of the advice, as finfluencers are unregulated and often inexperienced, yet command the attention of millions of followers.”

She went on to write that, while this new generation may “have started their investment journey” online, only a full-service firm like Odlum Brown can help them achieve wealth accumulation. “Think of our team as a personal and credible finfluencer.”

As for Mitchell, after several years of financial counselling off the side of his desk while working for UBC Enrolment Services, he finally decided to go full-time with the business in September. “I’m now taking on twice as many clients—and it’s going tremendously well,” he says, adding: “I know I’m doing something right when my clients tell me, ‘You have to raise your prices.’”

Read more from the Winter 2021 issue.